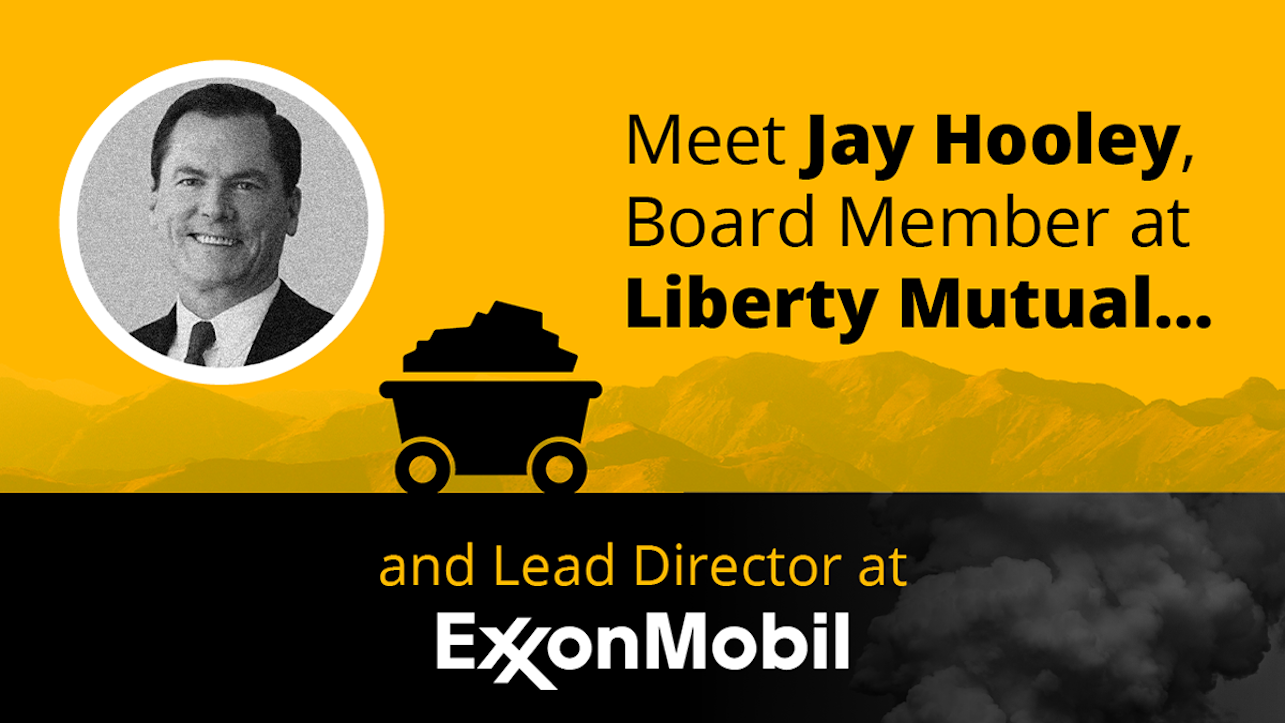

Boston, MA (May 26, 2022) – Today, LittleSis and Rainforest Action Network released a briefing report detailing the links between Liberty Mutual’s Board of Directors and fossil fuel interests, following the news that Liberty Mutual board member Joseph “Jay” Hooley officially became ExxonMobil’s new lead director yesterday. Find the full briefing here.

The research builds on a 2021 DeSmog investigation of global insurers’ links to polluting industries, which found that Liberty Mutual’s board had the most oil and gas ties of any insurer. As of today, 9 out of 13 Liberty Mutual board members – a whopping 69% – have close ties to, and are personally profiting from, extractive industries.* In addition to ExxonMobil, Liberty directors sit on the boards of Canadian Natural Resources Limited, Eversource Energy, Koch Industries, and other big polluters.

Insurance companies have come under increasing scrutiny in recent years because of the key role that their insurance and investing activities play in enabling the expansion of fossil fuel infrastructure. In response to campaigns led by the Insure Our Future coalition, more than 35 insurance companies have limited insurance coverage for the coal industry and nearly a dozen have ruled out insuring some or all new oil and gas projects, in an effort to accelerate a just energy transition. However, U.S. insurers, including Liberty Mutual, are global laggards when it comes to climate action, despite facing massive risks from climate-fueled extreme weather.

“Our findings illuminate a stark conflict at the heart of Liberty Mutual’s governance: board directors like Hooley are supposed to responsibly guide one of the world’s biggest insurance companies through the risks posed by the climate crisis and continued fossil fuel business, but they are simultaneously governing over and personally profiting from the expansion of fossil fuels,” said Yusra Bitar, Climate Justice Researcher at LittleSis.

Liberty Mutual claims to be a leader on sustainability and has taken some initial steps to address its contribution to the climate crisis, such as limiting insurance coverage for some coal-intensive companies and pledging a 50% reduction of Scope 1 and 2 global greenhouse gas emissions by 2030. However, these policies are far from best practice globally and allow Liberty to continue its unchecked support for fossil fuel expansion.

“As global insurers adopt policies limiting insurance for fossil fuel expansion projects, Liberty Mutual is continuing to provide a lifeline to the coal, oil, and gas industries,” said Elana Sulakshana, Senior Energy Finance Campaigner at Rainforest Action Network. “The fact that Hooley is the new lead director of ExxonMobil – and other board members are deeply entangled with other fossil fuel companies – helps explain why Liberty has been such a laggard when it comes to minimizing its contribution to the climate crisis. How can these directors responsibly manage Liberty Mutual’s energy transition while they have a vested interest in fossil fuel expansion?”

Despite Liberty Mutual’s coal policy, the company lags significantly behind its industry peers on concrete action to decarbonize its investment and underwriting portfolios. It is currently one of the top insurers of the oil and gas industry and has no formal policies in place to limit support for oil and gas projects or companies. By contrast, ten major insurers have policies restricting insurance for new oil and gas projects, thirteen insurers have adopted restrictions on insuring oil and gas drilling in the Arctic National Wildlife Refuge, and more than fifteen have restricted support for the tar sands oil sector.

* Note: A previous version of this release cited the number of board members with ties to extractive industries at 8, rather than 9.

***

For more information, contact Elana Sulakshana // sulakshana@ran.org // (703) 589-0040.