Liberty Mutual leads in terms of ties to the fossil fuel industry of 30 global insurers

October 7, 2021 — Twenty percent of directors at US insurance companies have worked in the fossil fuel industry, according to new research by investigative reporters at DeSmog. When the analysis is expanded to include ties to the largest emitting companies and financial backers of fossil fuels, that number rises to 62%. Liberty Mutual has the most ties to fossil fuels, but DeSmog identified systematic connections between insurers and fossil fuels across the world: globally, 11% of directors have worked in the fossil fuel industry; 53% are “climate conflicted.”

“The fact that 20% of US insurance directors are tied to the fossil fuel industry, and the majority have ties to the industries destroying our planet, undoubtedly plays a major role in their inaction on climate change. US companies continue to lag behind their global counterparts and insure fossil fuel expansion that climate science says our planet cannot afford,” said Ross Hammond, US Coordinator for Insure Our Future.

DeSmog examined 371 directors on the boards of 30 of the world’s largest property and casualty insurers. It looked at ties to coal, oil, and gas companies; the Climate Action 100+ list; and the major banks that provide support for the fossil fuel industry globally, following the same methodology as DeSmog’s recent analysis of bank directors. All insurance boards examined had ties to polluting industries, and over a quarter (8 of 30) had ties to coal.

“There is a notable prevalence of directors with current and past connections to some of the world’s most polluting industries on the boards of major insurers. This includes directors who currently hold leadership roles at major emitters, as well as others who’ve spent the entirety of their careers in high-carbon industries. Public support for scientifically-led action on the climate crisis is high, and the directors of these insurers have the chance to put themselves on the right side of history,” said Rachel Sherrington, lead researcher on the project.

Connecticut Citizen Action Group will bring banners to The Hartford’s headquarters today to call for the ouster of Director Michael G Morris, who features in the DeSmog analysis for his deep ties to fossil fuels, including as a former director of the climate-denying Business Roundtable. While The Hartford took an important step by adopting a tar sands and coal policy in December 2019, the company has failed to take action on oil and gas more broadly.

“Michael Morris embodies the destructive alliance between insurance companies and the fossil fuel industry. He has spent his career running fossil fuel companies, utilities, and advocacy groups for fossil fuels at the expense of our climate. If The Hartford wants to live up to its rhetoric on sustainability, it needs to remove Morris from its board and adopt policies that end support for all fossil fuel expansion,” said Tom Swan, executive director of Citizen’s Climate Action Group.

Liberty Mutual leads in terms of ties to the fossil fuel industry

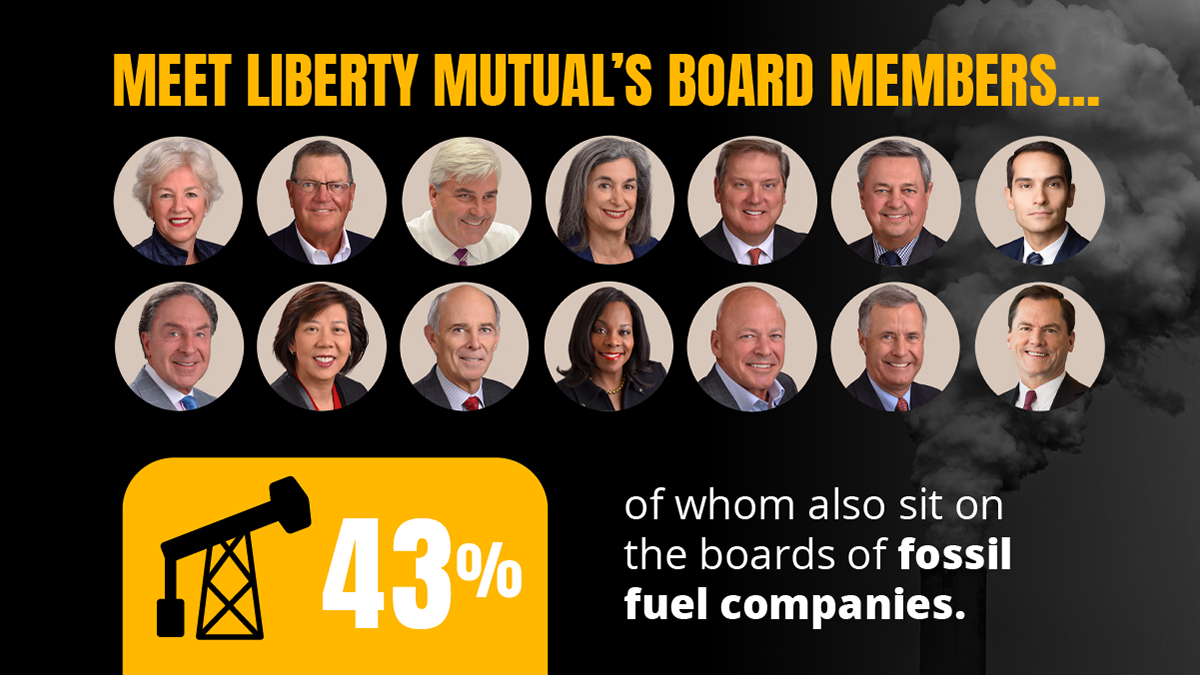

Boston-based insurer Liberty Mutual has the most ties to the fossil fuel industry of any company examined, with 8 of the 15 directors (57%) having worked in the fossil fuel industry and 6 (43%) holding current leadership roles at fossil fuel companies.

“Liberty Mutual is one of the biggest fossil fuel insurers in the world, and the fact that over 40% of their board members are also on the boards of fossil fuel companies helps explain why the Boston-based insurance giant has been so resistant to changing that. Liberty Mutual cannot credibly claim to be committed to climate action while its Board remains in the pocket of the oil and gas industry,” said Elana Sulakshana, Senior Energy Finance Campaigner at Rainforest Action Network.

Liberty Mutual CEO David Long, along with several other Liberty directors, are trustees of gas giant Eversource, a New England utility firm with an abysmal climate record. Director Jay Hooley is on the board of directors of ExxonMobil.

Liberty remains one of the top 10 oil and gas insurers in the world. It has come under fire for its involvement in Canada’s tar sands industry, and in particular for insuring the Trans Mountain pipeline. Liberty Mutual director Annette Verschuren is currently on the board of Canadian tar sands giant Canadian Natural Resources Limited (CNRL).

Systemic connections between insurance and fossil fuels across the world

In Europe, 11% of directors have worked in fossil fuels, and 57% are “climate conflicted.” In Asia, the numbers are substantially lower, in part due to lack of data: 4% and 31%, respectively.

In Europe, Italian insurer Generali’s board had the most ties to the fossil fuel industry, with 31% (4 out of 13 board members) having worked for fossil fuel companies. Generali Director Paolo di Beneditto, for example, is a current director of the Italian multinational electric utility Edison Spa. Director Gabriele Galateri di Genola is an advisor to Bank of America, the world’s fourth largest fossil fuel funding bank which has given over $190 billion to the industry since 2016.

While fewer connections were identified in Asia, several were notable, particularly for Tokio Marine. Director Masako Egaw is a current director of Mitsui & Co, which has significant stakes in the coal industry. His fellow Tokio Marine director, Shinya Katanozaka, is the current vice chair of Japanese business group Keidanren, which has been one of the most powerful actors holding back climate action in Japan over the last two decades. Tokio Marine recently adopted a coal policy, but it has significant loopholes, and the company still insures oil and gas expansion.

What does the insurance industry have to do with climate change?

As the ultimate manager of risk, the insurance industry quietly shapes modern society, deciding what type of projects can be built and operated. Without insurance, fossil fuel projects could not be built or operated. While some 30 companies worldwide have adopted policies restricting support for coal, many US companies still underwrite coal–some with no restrictions whatsoever. Almost all major property and casualty insurers still underwrite oil and gas expansion, despite findings from the International Energy Agency (IEA) that there is no room for any fossil fuel expansion in a Net Zero pathway. These same insurance companies invest in fossil fuel companies: US companies have over US $582 billion invested in fossil fuels.